Important Role of CRM in Banking Sector

Although, there are many banks who struggle a lot to make profit, still they hardly pay attention to enhancing their customer strategy. Now, those days are literally gone when people had a misconception about banks being okay with not on a client enough since they had clients. As per the statistics by Reichheld and Sasser, to demonstrate 5% growth in customer retention can increase the profitability up to 35% in the banking industry. Therefore, banks are now stressing on to retain the customers and rising up the market share. With such marvelous insights, it is yet a surety that CRM Solution will take off in the coming years ahead. In present Indian banking scenario, there are two prominent phenomena that are the focal points to emerge the practices and policies, which are the technology and the relationship marketing. According to the reports of Philip Kotler, CRM software is the process of carefully managing the information in detail about each and every individual customer and all customer touch points for maximizing the customer's loyalty.

Due to the increase in globalization, the new generations of private sector banks and many foreign banks have also entered into the market and they are bringing several useful and innovative products. Banks are required to differentiate themselves by adding the value-added services, offering and building long-term relationships with their customers. They need to offer the create a good customer experience by offering them more customized products, enhanced value offerings, personalized services and increased accessibility. Money related rebuilding and authoritative adjustment are the catchphrases for the management for addressing the development of difficulties emerging out in globalization. According to the reports, Yes Bank (YCCRM) has the prominent feature of discussion board and templates; on the other hand, Punjab National Bank (PNB) has deployed CRM software services with the modules of prospect management, lead management, and activity management while ICICI bank has identified the functional areas which are integrated on core businesses.

Issues & Challenges of CRM in Banking Stream

The following are the impediments to CRM implementation services:

-

Technological issue

Most of the officers perceive the technology limited to record the information and transaction about the customers. The use of technology in further sophisticated information processing and dissemination is no done. There are multiple integration channels that simultaneously use the latest technologies in customer interface, service, and sales.

-

People issue

It means the lack of knowledge and skills in converting data to customer knowledge. There is lack of motivation to utilize the potential of CRM software solution. There are less or insufficient decision-making authority and inadequate performance management parameters. In order to use the concept of CRM towards the customer centricity, sufficient decision-making power it requires to provide the customized, responsive and proactive services.

Issues & Challenges of CRM

-

Process issue

As CRM is an organizational wide strategy, so the complete process requires being aligned inappropriate manner. The CRM implementation demands a change in organizational culture in terms of shared values, vision and mission. The success of CRM software lies in the ownership by all the departments with marketing in the strategic role to combine all efforts towards better customer service.

Benefits of CRM in the Banking Sector

The CRM software is the most important business management tool for the banking industry. For any service-based organization, an apt customer relationship management is the primary determinant & capable of changing the face of the company. The great solutions can help any industry in marketing new customers, dealing closures and also to facilitating the outstanding support service. Following are the few key benefits of CRM software in the Banking industry:

-

Improved customer retention

To increase new customers is a difficult job for banks. In this tough market environment, retaining existing customers is also a difficult job. Retaining the existing customers becomes an important part to have a grip in this competitive market. The customer's retention can be accomplished by enhanced customers satisfaction and loyalty.

-

Boosted sales

Sales have become a crucial part of banks with an increase in the evolution of CRM. CRM software implementation assists banks in sales management with the sales modules. It also helps to identify and convert the leads into prospective customers and assist in the acquisition of new customers with the help of past track records.

-

More effective Marketing efforts

CRM services make the efforts of marketing deportment more productive & effective. It generates the report highlights that customers touch and data points, purchase behavior, engagement channels and much more. It also helps marketing team in exploring new marketing opportunities for engagement and retention.

-

Increased productivity

Having the entire data of the customers on a single screen, bankers can now spend more time on strengthening their customer relationship rather than spending time on gathering and organizing the data. It increases the productive by reducing cost with the help of minimizing or eliminating repetitive tasks.

-

Personalized Relationships

The ultimate objective of CRM software is to handle the customers on a personalized level, as apparent identity. It is quite difficult to keep the track records and follow up on each individual customer data and look at the trends. It also helps to overcome the difficulties by letting bankers provide personalized services to every customer.

Future Perks of CRM in Banking Industry

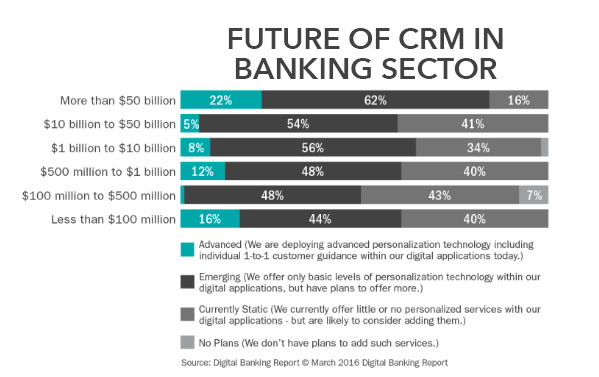

Potentially, as the banking industry seeks to replicate the digital experience of such customer-centric companies like Uber, Apple, Facebook, Amazon, and many others, the banking is usually unable to leverage the insights on customers for the advantages of these same customers. Despite the most universal agreement that the banking industry requires improving the use of data for delivering an enhanced customer experience and reduce the cost of technology to deliver on this promise, advanced analytics remains a low priority according the Digital Banking Report, State of Financial Marketing. According to the reports of State of Financial Marketing, while the banking industry players indicate that they need to deliver the real-time insights to customers, less the 20% of the players are currently capable of doing so. Of more concern, a rough estimate of 40% of all but many large financial institutions’ tale places them in the “Static Self Assessment Category”. The custom CRM Software will improve the success level of banks in meeting sales, marketing, and customer objective goals. The banks ought to spruce up their performance for lead conversion and the customer retention on regular basis.

With so many options available in the ever-evolving market, the customers can literally pick and choose, where they will receive advice, invest their money, take out the loans and purchase financial products. According to Accenture, the consumer has indicated that they would like banking experience to be seamless and an almost invisible part of their day-to-day life. In order to be ahead in this competitive market, your CRM in financial service institutions needs to have brand authority in the market which shows that yours is the only organization that can be chosen. From the advent of the drive-up teller, credit card and debit cards, ATM and direct deposit, etc the industry has changed a lot and leveraged the technology to simplify the segment. In annual recent reports by digital banking, to remove the frictions from customer journey was the second most mentioned prediction by close to 100 financial service industry leaders surveyed. According to J.D. Power, the largest banks have the best customer satisfaction scores for the first time ever with the potential to steal business from small players.

Conclusion

Effective CRM software has many advanced features which allow banks to link with their customers and hence build a long-term relationship, helps to set apart the competition. CRM is no longer optional for banks but is important for its success. So it is high time to be the bank your customers love with optimal CRM implementation.

Recent Blog

Why Your Business Needs a Mobile App?

06-Dec-2022Related Blogs

A secret of Mobile Application Development

23-Apr-2018

Market Demand for CRM and ERP Development

07-May-2018